When you think of brokerage accounts and investing money, nonprofits typically aren’t what comes to mind. You may not even know that nonprofits can invest funds or why they would. However, if your organization is looking to improve its cash management and earn more large donations—opening a brokerage account is likely the perfect solution.

In this guide, we’ll break down everything you need to know about brokerage accounts for nonprofit organizations, including:

- Nonprofit Brokerage Account FAQ

- How to Open a Brokerage Account for a Nonprofit Organization

- Why You Should Partner with Nonprofit Investment Account Experts

Managing your nonprofit’s finances is a complex process, especially when it involves navigating a type of account you’ve never used before. Let’s dive into the details so you can feel prepared to open a brokerage account for your nonprofit and understand the best options available to you.

Nonprofit Brokerage Account FAQ

Before we explore the steps of opening a brokerage account for a nonprofit organization, let’s address any questions you may have.

What is a Brokerage Account?

A nonprofit brokerage account is an investment account that an organization can use to invest funds, receive stock donations, and grow its reserve funds.

Instead of only holding cash like a regular bank account, brokerage accounts can hold stocks, bonds, and mutual funds in addition to cash. These accounts are managed by a brokerage firm, online broker, or other investment advisor that handles the logistics of trading and processing stocks for you.

Can a Nonprofit Have a Brokerage Account?

Yes, nonprofit organizations can open their own brokerage accounts. Not only that, but we believe every nonprofit should have a brokerage account.

While an individual or company may use an investment account to make a profit, the purpose of a nonprofit brokerage account is to earn more donations for the organization’s cause and attain greater financial sustainability. By soliciting stock donations and investing in low-risk, highly liquid investment strategies, you can grow your organization’s financial capacity to weather economic changes and devote more to your mission.

Plus, brokerage accounts can be used to increase your FDIC coverage from $250k to up to $5M through a sweep program. This can significantly streamline and strengthen your financials. And since 501(c)(3) organizations are tax-exempt, you won’t have to pay federal income taxes on the appreciation of your account’s assets like an individual would.

Why Do Nonprofits Need Brokerage Accounts?

Ultimately, brokerage accounts help nonprofits effectively steward their finances, promoting organizational stability and longevity.

Opening a nonprofit brokerage account comes with many benefits, including giving your organization the ability to:

- Invest your reserve funds. The most common draw of opening a brokerage account is that it allows you to invest funds. For a nonprofit, this means investing your reserve funds in low-risk strategies to give them the chance to grow over time. In comparison, keeping your reserve funds in a savings account alone can cause you to lose money over time due to inflation.

- Accept and process stock donations. Donating stocks is highly appealing to donors since they receive additional tax benefits and can end up donating more to your nonprofit than they originally paid for the stock. However, you can’t accept these donations without a brokerage account. Opening one allows you to tap into this up-and-coming donation opportunity and give wealthy donors more ways to support your cause.

- Get more FDIC coverage. Having a brokerage account also gives you access to a sweep program for your cash, enabling you to get more FDIC coverage for a single account. With an Infinite Giving account, for example, you can get FDIC coverage for up to $5 million, far above the typical $250,000 max you get with a regular bank account. This not only better protects your funds, but it also simplifies bookkeeping because you only have to manage one account to retain coverage.

Together, all of these factors can help your organization achieve greater financial sustainability long term.

If you’re excited about investing or improving your cash management with a brokerage account, take time to develop your nonprofit’s Investment Policy Statement (IPS) before you dive in. An IPS outlines specific rules and governance policies you’ll use to manage any investments you make, including stipulations for how donor funds can be used. You can create this document with the help of a nonprofit investment advisor or by using a template like Infinite Giving's free IPS template.

What Are the Best Brokerage Accounts for Nonprofits?

Nonprofits have a few options when it comes to opening a brokerage account. You can choose a traditional brokerage firm like Fidelity or Schwab, which have specific brokerage accounts for nonprofits alongside their other options. However, these accounts tend to have high balance minimums and more difficult application processes.

To make the process easier, consider working with a nonprofit investment advisor like Infinite Giving instead. These experts can open a brokerage account for you in as little as three business days and ensure that it meets your organization’s needs.

Watch the video below to get a quick overview of all the ways this option can help your organization succeed:

How to Open a Brokerage Account for a Nonprofit Organization

Ready to open a brokerage account for your nonprofit? Follow these three steps to get started:

1. Consider Your Options

There are a variety of firms, banks, advisors, and online platforms that offer brokerage services for nonprofits. However, not every bank and advisory firm works with nonprofits, so be sure to find one that welcomes tax-exempt entities. Do extensive research on any brokers you consider, as you’ll be trusting them to manage large amounts of your organization’s funds.

As you weigh your options, consider important factors like:

- Fees

- Account minimums

- Speed of opening an account, processing stock donations, etc.

- Available investment options

- Customer support

- Nonprofit expertise

- Accessibility for small and mid-size organizations

To help you make an informed choice, we’ll go deeper into the pros and cons of two main options: going the traditional route and partnering with a specialized nonprofit investment advisor.

Traditional Brokerage Accounts

In the past, most nonprofits’ only option was to open an account with a big bank or brokerage firm. Now, more specialized advisors and platforms exist to help nonprofits open brokerage accounts and manage their funds effectively.

However, you can still choose to open a brokerage account with a traditional brokerage firm like Fidelity or Schwab if you determine that’s the best fit for you. Just keep in mind that this option can come with substantial drawbacks, such as:

- Inefficient, manual processes for opening an account and processing stock donations.

- Lengthy application and approval timelines.

- Lack of transparency into donor contributions.

- Manual, time-consuming liquidation processes for stock gifts.

- Having to manually create and send stock donation receipts, which is a complex and tedious process.

Working with a Nonprofit Investment Advisor

On the other hand, you have the option to partner with a specialized nonprofit investment advisor like Infinite Giving who opens a brokerage account for you and takes extensive work off of your plate.

By working with Infinite Giving, you can access benefits like:

- A streamlined process for donors. If you use a traditional brokerage firm, donors who want to gift stock have to follow a complicated process—they would need to call your organization, download a PDF request form, ask their advisor to call your organization, and more. With Infinite Giving, donors can complete the entire stock donation process online in as little as 10 minutes.

- Faster application process. Instead of spending ages filling out a lengthy application and then waiting weeks for approval, you can apply for an account with Infinite Giving in as little as 30 minutes and open a nonprofit brokerage account in just three business days.

- Real-time donor transparency. Traditional brokerage accounts don’t give your organization the names of any stock donors, causing you to miss out on valuable opportunities for donor stewardship. Infinite Giving, however, gives you complete, real-time transparency into all of the stock donations you receive. See everything from an intuitive dashboard so you can make the most of every opportunity for connection.

- Automatic stock donation liquidation. Infinite Giving’s stock donation tools allow your nonprofit to accept stock gifts online and automatically liquidate them to cash so you don’t have to worry about fluctuating value. With a traditional firm, you would have to manually request liquidation every time you want to convert a donation to cash.

- Branded donation receipts. Stock donation receipts aren’t the same as the receipts you give for cash contributions. You can’t list a dollar amount and should instead provide the stock identifier, number of shares, and date of the transaction. Infinite Giving creates these complex receipts for you and brands them to your nonprofit for an added professional touch.

Plus, choosing this option means you’ll have years of nonprofit expertise on your side. These advisors are not only financial experts—they also know the ins and outs of nonprofit finances and understand what drives your decision-making. With this insight, they can provide you with an all-around better brokerage account experience.

2. Complete the Application Process

No matter which option you choose to open a nonprofit brokerage account, the application process follows the same basic structure:

- Fill out an application with the firm or advisor.

- Provide contact information and documentation like your IRS 501(c)(3) determination letter, articles of incorporation, and bylaws.

- Provide a balance minimum to open the account.

- Wait for approval from the broker.

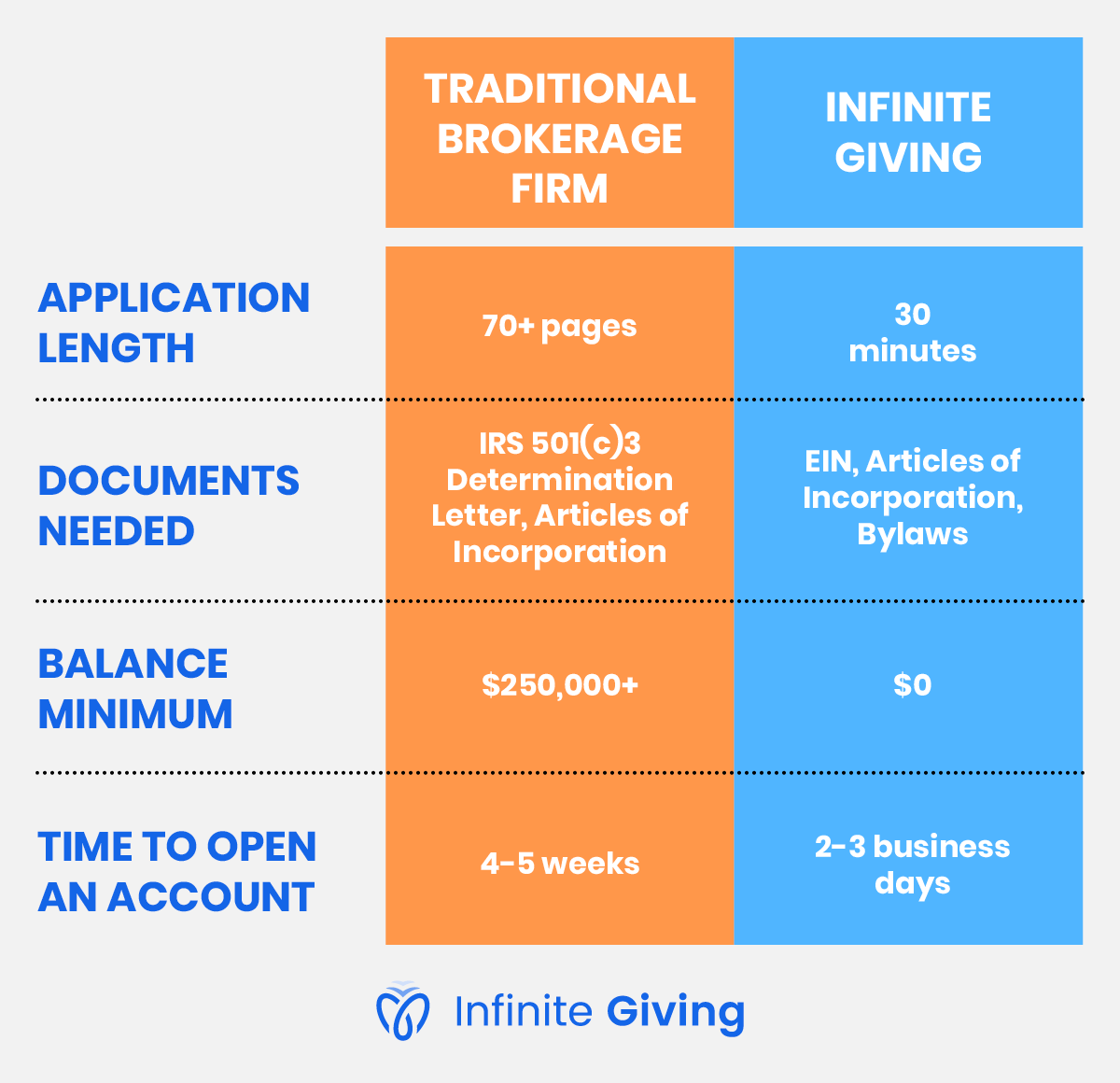

However, the length of this process and the work involved on your part can vary greatly depending on who you open your account with. Let’s break down some key differences between the application process for traditional firms and Infinite Giving:

- Application length: Traditional brokerage firms’ applications can range from 20-70+ pages long. You can apply for a nonprofit brokerage account with Infinite Giving in as little as 30 minutes online.

- Documents needed: Both applications require your IRS 501(c)(3) determination letter and articles of incorporation. However, Infinite Giving can locate your determination letter for you, removing an extra step for your team. Check the specific application requirements for your broker to see if you need any additional documentation.

- Balance minimum: Traditional firms can have high balance minimums of $250,000 or more. Infinite Giving’s minimum is $0 to access stock giving and only $100,000 for investing, making it more accessible for smaller organizations.

- Time to open an account: You may have to wait 4-5 weeks for approval from a traditional brokerage firm. If you apply for an Infinite Giving account, you can get your nonprofit status verified and open the account in just 2-3 business days.

To prepare for the application process, make sure you have all of the necessary documentation on hand along with approval from internal stakeholders. Meet with your board and nonprofit leadership to discuss the implications of applying for a nonprofit brokerage account and ensure that everyone’s on the same page before moving forward.

3. Start Funding Your Nonprofit Brokerage Account

Once your nonprofit’s brokerage account is open, it’s time to start filling it with funds!

As mentioned earlier, you may need to provide a certain amount of money upfront to open the account. Be sure to check with your firm or provider to verify what these requirements are. Then, you can supplement these original funds by transferring reserve funds from other accounts and soliciting stock donations.

Now that you have the infrastructure in place, you’re ready to accept stock donations and publicize the option to donors. With Infinite Giving, the process of accepting stock gifts works like this:

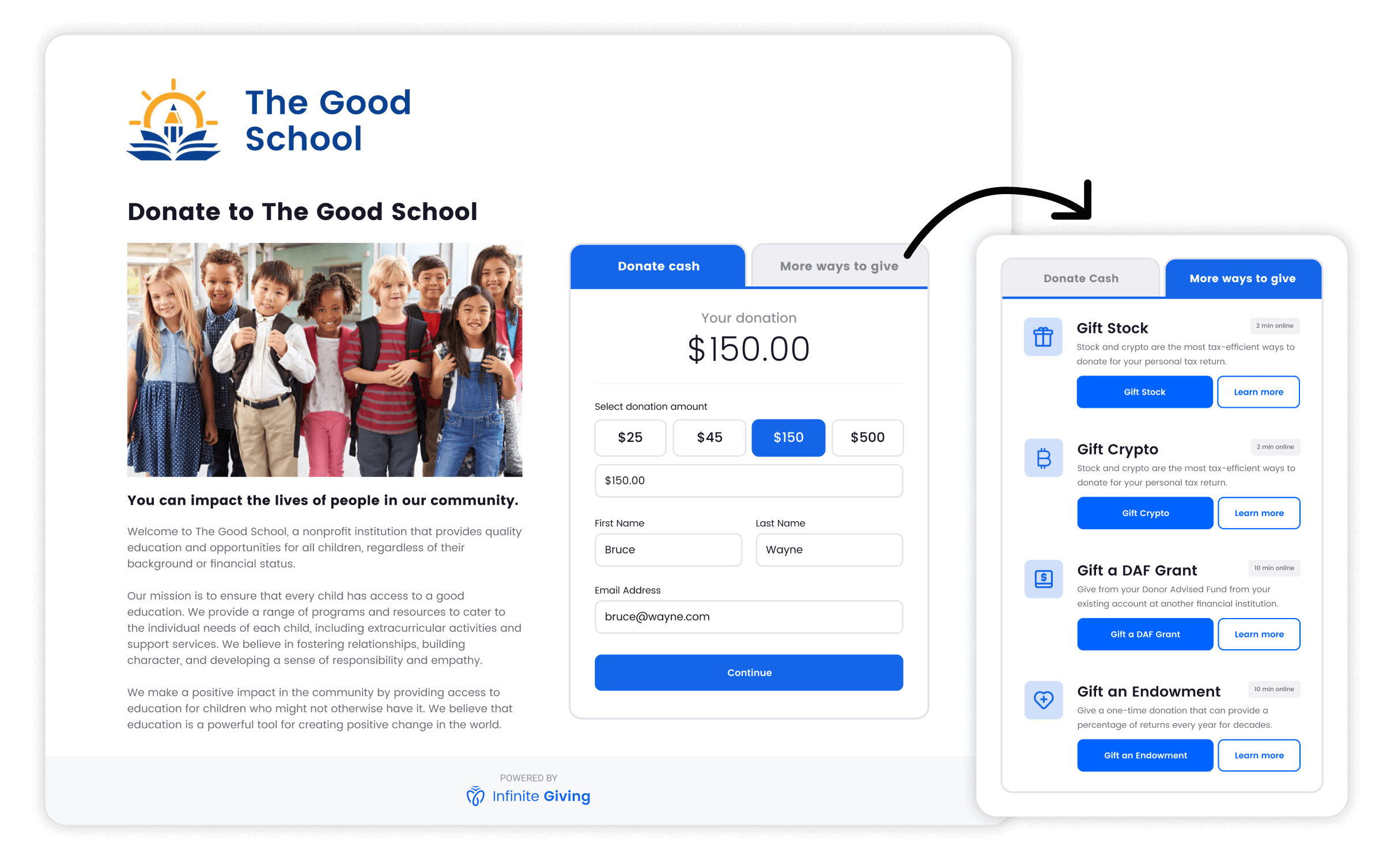

- Set up your all-inclusive donation page and share your giving link. From your branded online donation page, donors can give stocks, cryptocurrency, DAF grants, and endowment gifts.

- Donor fills in information about their stock gift. Right from your donation page, they input their contact information, brokerage firm, and information about the stocks they want to donate.

- Donor gets an email to forward to their broker to initiate the stock transfer. Immediately after filling out the donation form, they’ll get all the information they need to send to their broker to make the stock transfer request as easy as possible.

- Your nonprofit receives the stock, which gets automatically liquidated to cash. Once the transfer is complete, you receive a cash donation and your donor receives a branded stock donation receipt.

Be sure to spread the word about this new giving option by adding information to your Ways to Give page and promoting stock donations across marketing channels. Consider conducting individual outreach to donors you think would be particularly interested, too.

Why You Should Partner with Nonprofit Investment Account Experts

Choosing to open your investment account with a nonprofit investment advisor instead of a traditional brokerage firm can make a huge difference in the success you see with your account.

By partnering with a nonprofit investment advisor like Infinite Giving, you’ll receive a variety of additional perks that can help you manage your finances and earn more asset donations. These services include:

- Nonprofit investment expertise and advising.

- Intuitive dashboards with transparent reporting.

- Handling stock donation receipts for you.

- Endowment creation and management.

- Fiduciary services.

- Making it easy to accept non-cash donations beyond stocks.

Just take a look at the all-inclusive, branded donation page you’ll receive by partnering with Infinite Giving:

With these tools and expert guidance, you’ll empower your supporters to donate larger amounts in more tax-efficient ways. You’ll also have nonprofit financial experts by your side every step of the way as you move toward long-term financial sustainability.

Additional Resources

Now that you understand the basics of nonprofit brokerage accounts, you’re one step closer to improving your organization’s cash management. Once you have a brokerage account, you can move forward with exciting opportunities like investing and accepting all kinds of non-cash contributions for your cause.

For more insight into everything you can achieve with a nonprofit brokerage account, check out the following resources:

- Nonprofit Investing: The Ultimate Guide to Grow Your Giving. Excited to start investing your reserve funds and grow your giving? Read up on nonprofit investing basics and best practices in this guide.

- How to Accept Stock Donations: The Ultimate Nonprofit Guide. Learn more about the process of soliciting stock donations once your nonprofit brokerage account is up and running.

- Nonprofit Endowments: The Ultimate Guide to Grow Your Fund. Interested in other forms of high-impact giving? Read this guide to nonprofit endowments, which can sustain your organization for years to come.

.svg)

.png)

.png)